Why Choose

E BATI Customs

E-Batı Customs Consultancy continues to provide consultancy services to many large domestic and foreign companies in foreign trade issues as well as customs consultancy services with its staff serving in the sector for more than 30 years. Our group, in parallel with the developing foreign trade of our country, customs consultancy, consultancy, foreign trade, transportation, logistics. It continues its services with bonded / unbounded storage branch companies.

E Batı Gümrük Müşavirliği

Gül Yapı Skyport Residance Hürriyet Bulvarı No:1 D:57 Beylikdüzü/İstanbul

Phone: +90 212 875 81 51

Fax: +90 212 879 04 40

E-mail: info@batigumruk.com

Our Services

As a company, we consider ourselves a part of the companies we serve. Our most important goal is to eliminate their troubles, to ensure the uninterrupted continuation of production, to realize exports, to make transactions on time and correctly, to integrate with the companies we represent and to work in harmony. We know very well that; We are an important service sector. We are assertive in providing services to our companies. But we never forget that; We exist if we have companies. Our Principle; To provide safe, accurate and fast service.

In our country, Customs is an institution operating under the Ministry of Trade. Customs Clearance Service is the execution of business and transactions with the state in the passage of products or services through customs areas during foreign trade transactions with a foreign country.

Foreign trade rules to be followed during the whole process of the Customs Law No. 4458, which is the main source of law in Turkey's customs. The purpose of this law is entering the Republic of Turkey Customs Zone and will be applied to the goods and vehicles customs rules belirlemektir.4458 Customs Law No. 5. All persons compared to substances may appoint a representative to work in customs administrations to perform prescribed by the customs legislation of savings and transactions. Except for persons engaged in transit or in an occasional declaration, customs representatives are persons resident in Turkey.

Foreign trade rules to be followed during the whole process of the Customs Law No. 4458, which is the main source of law in Turkey's customs. The purpose of this law is entering the Republic of Turkey Customs Zone and will be applied to the goods and vehicles customs rules belirlemektir.4458 Customs Law No. 5. All persons compared to substances may appoint a representative to work in customs administrations to perform prescribed by the customs legislation of savings and transactions. Except for persons engaged in transit or in an occasional declaration, customs representatives are persons resident in Turkey.

Representation can be direct or indirect. The representative acts on behalf of someone else in the case of direct representation, and in the case of indirect representation on his own behalf, but on the account of someone else. The representative must declare that he acts on behalf of the represented person, indicate whether the representation is direct or indirect, and submit the certificate of representation authorization to the customs authorities.

The self-employed persons who follow and conclude all kinds of customs procedures of the goods or services subject to customs procedures through indirect representation and who are given a permit by the Undersecretariat of Customs are also called Customs Brokers. Within the scope of customs clearance services, customs consultants act on their behalf but as someone else's representative through indirect representation. Customs brokers are obliged to declare that they act on behalf of the person represented and to submit their representation authorization certificate to the customs administrations.

The self-employed persons who follow and conclude all kinds of customs procedures of the goods or services subject to customs procedures through indirect representation and who are given a permit by the Undersecretariat of Customs are also called Customs Brokers. Within the scope of customs clearance services, customs consultants act on their behalf but as someone else's representative through indirect representation. Customs brokers are obliged to declare that they act on behalf of the person represented and to submit their representation authorization certificate to the customs administrations.

The most important factor that foreign trade organizations should pay attention to when it comes to Customs Clearance Service; It is the choice of an experienced, reliable, authorized customs clearance company with accurate guidance. It should not be forgotten that a wrong choice to be made and a wrong transaction to be made easily carry the risks of being evaluated within the scope of customs smuggling and penalties and these will expose foreign trade companies to unrecoverable expenses, penalties, time and prestige losses.

E BATI Customs Consultancy has been successfully following and finalizing the customs procedures listed below in all Customs and Trade Directorates affiliated to the Ministry of Trade and affiliated official institutions and organizations on behalf of its valued customers for many years.

- Import Customs Operations

- Export Customs Operations

- Transit Trade Operations

- Inward Processing Operations

- Outward Processing Operations

- Processing Regime Under Customs Control

- Warehouse Operations

- Temporary Import Operations

- Temporary Export Operations

- Transit Regime Operations

- Postal Customs Operations

- Free Zone Operations

- Re-Export Operations

- Destruction Operations

- Abandonment to Customs Operations

- Exemption and Exemption from Customs Duties

- Operations Regarding the Goods to be Purge

- Returned Item Operations

- Border Trade Operations

Export Operations

Export transactions are carried out accurately and quickly through our company's expert team and time loss in the process is prevented.

Release for free circulation of goods from the customs territory of Turkey; The implementation of trade policy measures is possible by completing other procedures for the importation of the goods and collecting taxes payable by law.

Import service headings are as follows.

- Feasibility study for the goods to be imported.

- Inward Processing Regime applications.

- Follow-up of all stages from the order in Door to Door transactions.

- Tracking the travel and document information of the goods from the shipping company.

- Making bill of lading endorsements of documents (if any).

- The receipt of the order.

- Regarding the goods G.T.İ.P. detection.

- Classification of the original certified relevant documents and delivery to the operations department.

- Customs Operations (Küşat): If the owner of the goods has a need such as GTIP determination and determination of origin, sampling, inspection of the goods for the goods coming to Customs, the owner or his legal representative shall make a request to the Customs administration.

- Starting the customs acceptance and registration process and making the inspection of the goods.

- Keeping the minutes in case of deficiency, damage or error and informing the relevant units.

- Making the related security or tax payments by making the accruals.

- Physical delivery of the goods to the address specified in the instruction given by the relevant companies.

- Delivery of documents to you with the document delivery form.

Import Operations

It stands by you with its meticulous work on import transactions and serves with its experienced staff to complete the transactions smoothly.

Release for free circulation of goods from the customs territory of Turkey; The implementation of trade policy measures is possible by completing other procedures for the importation of the goods and collecting taxes payable by law.

Import service headings are as follows.

- Feasibility study for the goods to be imported.

- Inward Processing Regime applications.

- Follow-up of all stages from the order in Door to Door transactions.

- Tracking the travel and document information of the goods from the shipping company.

- Making bill of lading endorsements of documents (if any).

- The receipt of the order.

- Regarding the goods G.T.İ.P. detection.

- Classification of the original certified relevant documents and delivery to the operations department.

- Customs Operations (Küşat): If the owner of the goods has a need such as GTIP determination and determination of origin, sampling, inspection of the goods for the goods coming to Customs, the owner or his legal representative shall make a request to the Customs administration.

- Starting the customs acceptance and registration process and making the inspection of the goods.

- Keeping the minutes in case of deficiency, damage or error and informing the relevant units.

- Making the related security or tax payments by making the accruals.

- Physical delivery of the goods to the address specified in the instruction given by the relevant companies.

- Delivery of documents to you with the document delivery form.

Transit Trade Operations

Our company, which ensures the smooth transfer of goods through the borders of the country in international trade, ensures that you carry out the transit operations completely.

Transit, import duties and trade policy measures applied to the unreacted free movement of finished goods not subject to customs supervision and customs operations relating to exports from one point to another within the customs territory of Turkey to carry.

Transit regime; the national transit regime, the Customs Convention on the International Transport of Goods under the Protection of TIR Carnets (TIR Convention) dated 14.11.1975, the Convention on the Common Transit Regime dated 20/5/1987, approved by Law No. 6333 of 22.6.2012, It covers transit operations under the Import Convention and the Convention between States Parties to the North Atlantic Treaty on the Status of Forces dated 19/6/1951.

The customs authorities of the Customs Territory of Turkey goods placed under the transit regime;

- From a foreign country to a foreign country,

- From a foreign country to Turkey,

- From Turkey to a foreign country,

- It allows transportation from one domestic customs office to another domestic customs office.

It is mandatory to provide a guarantee to ensure the payment of any customs taxes that may accrue for transit goods. But; No guarantee is required for the transports by air, pipeline, rail or sea, except for the cases specified by the regulation.

General regulations regarding the Transit Regime;

- Between Articles 84 and 92 of the Customs Law,

- Between Articles 212 and 244 of the Customs Regulation,

- Customs General Communiqué with Serial No. 4 (Transit Regime)

- It is included in the Circulars no. 2012/4 and 2018/19.

Fair Operations

ATA carnets are customs documents that allow the temporary import and export of goods between the party countries within the scope of the International Temporary Import Agreement (in short, the Istanbul Convention) and its Annexes, without the need for any other document.

Warehouse (Bonded / Non-bonded)

Bonded / Unbounded Warehouse Services

Free Zone Operations

In the Free Zones Law No. 3218, the main objectives of the establishment and operation of free zones are; Encouraging export-oriented investment and production, accelerating foreign direct investments and technology entry, directing businesses to exports and developing international trade.

Highway Operations

Highway Operations

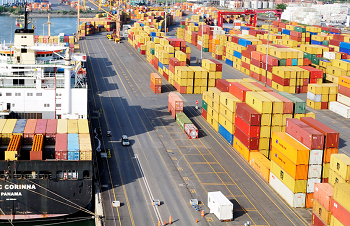

Seaway Operations

Seaway Operations

Airline Operations

Air Cargo Operations